Female leaders in cyber insurance are not unicorns. Yet, in an industry that is facing a severe talent shortage, it is a wonder why more of them do not exist; perhaps much of this gap could be considerably filled if 49.5% of the world’s population was proportionally represented in the industry – women. This International Women’s Day, the Cyber Insurance Academy has committed to raising awareness for the need for better Diversity & Inclusion, and is shining a spotlight at some of today’s leading women in cyber insurance.

The Current Representation of Women in Cyber Insurance

The cyber industry is facing a severe shortage of talent, with a worldwide staffing gap of nearly three million cybersecurity professionals, according to estimates from the InfoSec Institute. In North America alone, the talent shortage is half a million. Meanwhile, the demand for cybersecurity resources is expected to grow dramatically, as our reliance on technology burgeons. Despite this high demand, women make up only 25% of the cybersecurity workforce. This gender gap is particularly evident at leadership level, with only 11% of cybersecurity executives being women.

The insurance industry is also experiencing a shortage of women in leadership positions. According to S&P Global Market Intelligence, in late 2020 there were only seven female CEOs in the U.S. insurance sector. Million Women Mentors (‘MWM’) reported that women comprise more than 60% of the insurance industry but hold only 19% of board seats. They also revealed that only 8% of insurance companies have formal programs to develop strong careers for women. Gender pay gaps are also telling: MWM claims that the proportion of men in the insurance workforces begins to outnumber women in the $100,000 to $119,999 salary range.

The shortage of women in both the cyber and insurance industries is a significant problem that needs to be addressed. The lack of female representation at the leadership level is particularly concerning, as diversity is crucial to building a more effective workforce. Research studies have shown that creating a diverse workplace environment can make organizations more innovative and higher performing. Women bring essential soft skills to the table, including analytical, communication, and interpersonal abilities, which are crucial in the cybersecurity field. In addition, having more women in leadership roles can serve as role models for younger women and help attract more women to the industry. As the cyber insurance industry continues to grow, it is essential to have a diverse workforce that reflects the customers it serves.

More on the cyber insurance talent shortage.

5 Tips From 5 Cyber Insurance “Sheroes”

The Cyber Insurance Academy team interviewed fived of the most prominent role models in the cyber insurance industry. They were each asked the same question: “What does it take to be a female leader in the cyber insurance industry?”.

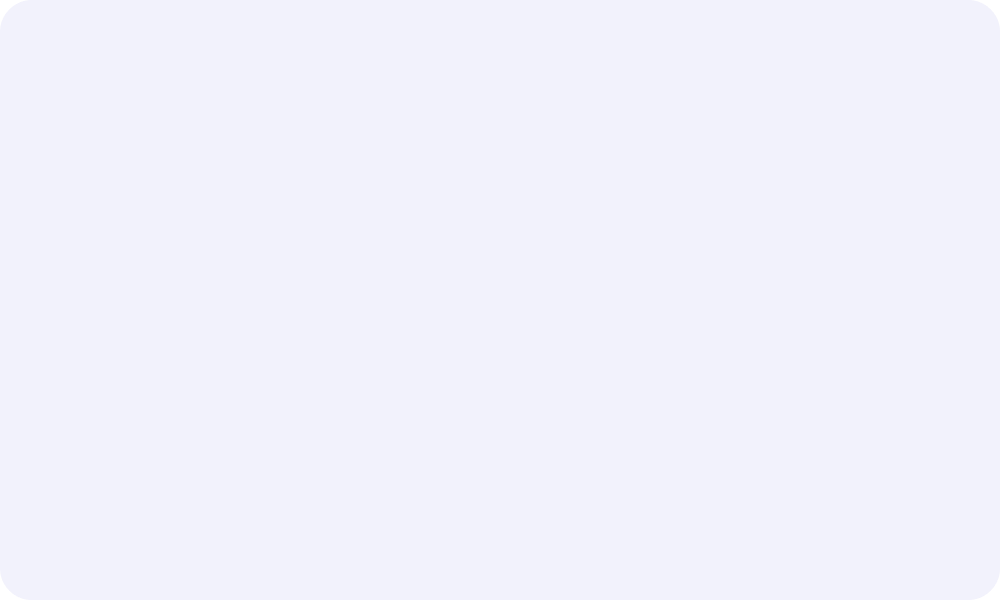

Prepare to fight for yourself

“Firstly, I think you need to understand that as a woman you are going to have to work harder to get to where you want to go,” says Jacqui Spencer-Sim Divisional Director Cyber at Hamilton Insurance Group. Aptly put by Dr. Anjali Camara, Partner at Connected Risk Solutions, female leaders must “be realistic, but not let it stop them”. This is further echoed by Lindsey Nelson, Cyber Development leader at CFC, who says: “Being a female leader – or any leader – in Cyber, means knowing that opportunities don’t just happen, you have to create them”.

But what of those women in the cyber insurance field who lack the confidence to put themselves out there, crippled by feelings of self-doubt and inadequacy? Emily Selck, National Director of Cyber Strategy at Baldwin Risk Partners, feels that removing the perception that women are not as technically skilled as their male counterparts and the impostor syndrome this espouses is key, and encourages other women in the industry to have “the confidence to keep raising your hand because what you have to say is just as important”.

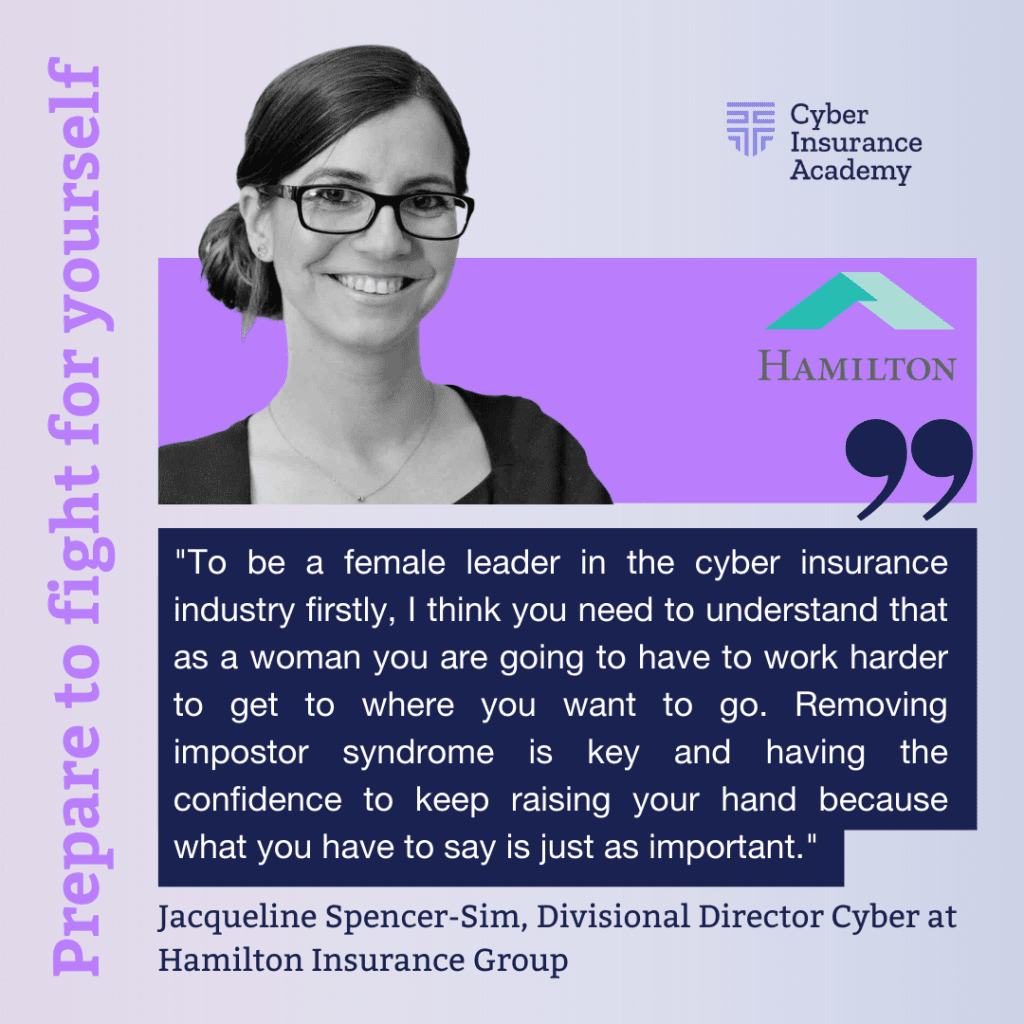

Find a balance… or not

Almost all the women the Cyber Insurance Academy interviewed shared a similar view: being a female leader in cyber insurance is as much about promoting personal success as it is about encouraging development in others. It’s about a “willingness to help grow others”, says Shannan Fort, Financial Lines and Cyber Partner at McGill and Partners. Summarized by Emily Selck: “Know who you are, trust yourself and mentor and motivate those around you”.

Indeed, the women we interviewed demonstrated a powerful understanding of the importance of nurturing their team by providing mentorship, support, and opportunities for growth, ultimately leading to a more successful and engaged workforce. Interestingly, Lindsey Nelson advocates for removing the corporate world’s taboo around encouraging a personal life outside of work, stating that “being a female leader in Cyber means having the confidence to promote a work-life balance. Know what drives your team outside of work, become an interesting person outside of the office, and learn how that same drive can be used to breed innovation and authenticity in the workplace”.

Make Lemonade

Unconscious gender bias in the workplace has left many women being stereotypically associated with “soft skills” such as empathy, communication, and organization, leading to undervaluing their contributions in more technical or strategic areas. This bias has reinforced gender stereotypes and hindered women’s career advancement, perpetuating the gender gap in leadership positions.

But Emily Selck illustrates how this can be turned on its head and used to a female leader’s advantage: “I feel the greatest skill women can have in cyber insurance is the ability to ask leading questions and listen to what our clients have to say (and what can go unsaid). As an emerging risk, cyber risks can be easily misunderstood but our ability to listen can be more powerful than talking – we, as women, have done a great job of honing this skill”. Dr Anjali Camera presses on this topic further, urging other female leaders in cyber insurance to “Investigate. Ask questions. Don’t hesitate to be in opposition, in the minority or to be opinionated”.

“We’re challenged to display all of these characteristics and still balance that with some element of softness and deference to our male peers so as not to be labeled as aggressive, reaching or feared,” explains Shannan Fort, “It’s time that we drop the balance and lean into aggressive, reaching and feared!”.

Veer off your lane

Research suggests that women are stereotypically more likely to “play it safe”, especially in their professional lives, as they are often penalized more severely than men for making mistakes or taking risks that do not work out.

Touching on this phenomenon, Dr. Anjali Camara, Partner at Connected Risk Solutions, states that “the worst advice I’ve ever received was to “stay in your lane”. I firmly believe that to be a leader, especially a woman, and a woman of color, you undoubtedly cannot stay in your lane. Veer. Take a couple of hits. Crash even. Then adjust, rebuild, and move forward… always be malleable, always be nimble, always be receptive to the unfamiliar, and always stay comfortable with being uncomfortable”. Moreover, encouraging women in cyber insurance to “lean in” to risk must also go hand in hand with industry-wide initiatives to ensure that men and women receive the same rewards when taking the same risks.

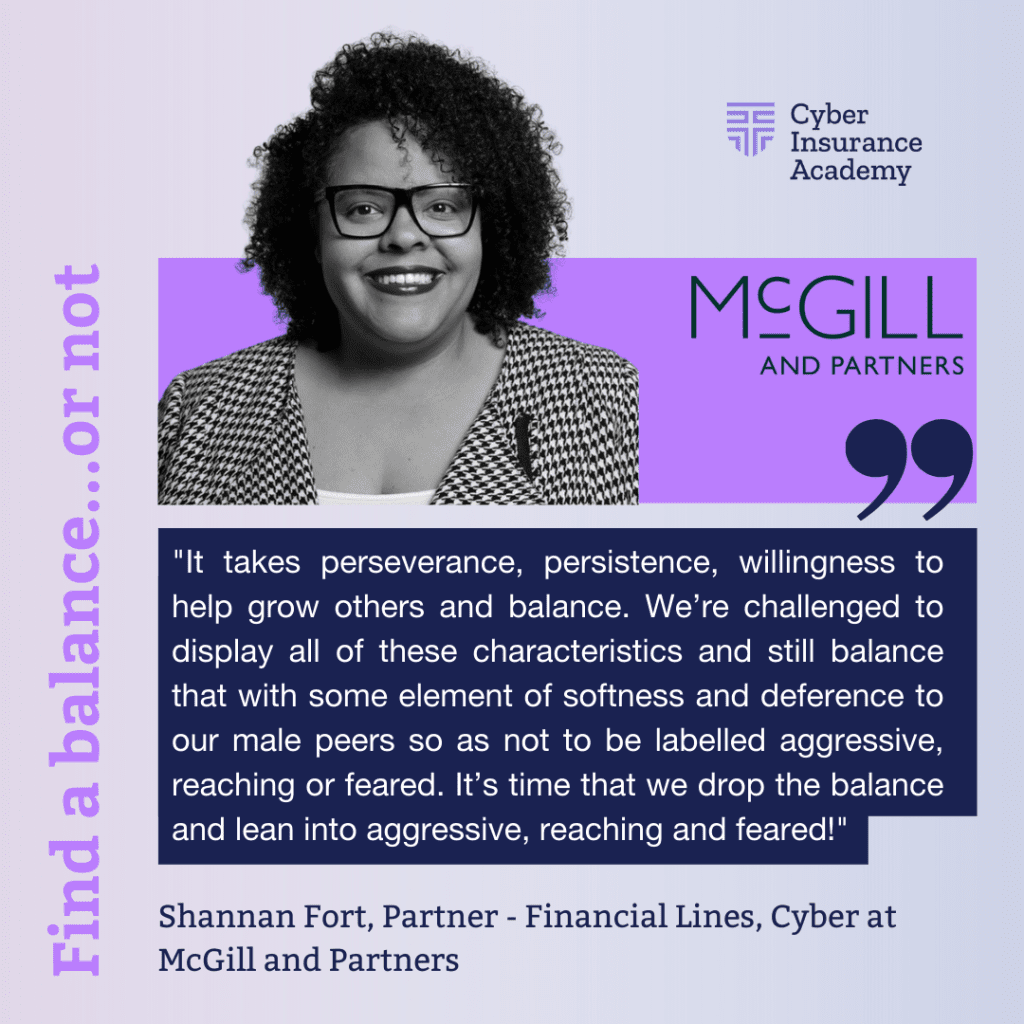

Treasure your relationships

A final word of advice from Lindsey Nelson: “Technology can replace many things, but insurance is inherently a relationship business”. She explained that invaluable relationships built through networking can be turned to for guidance through challenges, for answers and for resources, and should be treated as prized possessions in the cyber insurance industry.

In conclusion, elevating women in the cyber insurance industry is not only a matter of fairness and equity but also a strategic imperative for the industry’s success. The industry can only benefit from a diversity of perspectives, experiences, and skills that women bring to the table. By promoting and supporting women in the industry, we can create a more inclusive and dynamic environment that fosters innovation and growth. We are extremely grateful to the female leaders that have shared their valuable insights and experiences with our Community this International Women’s Day. Their perspectives serve as an inspiration to us all and a reminder of the importance of promoting and supporting women’s leadership in the industry.

Find out more about the Cyber Insurance Academy and the educational opportunities we offer.